Personal finance advice I wish I knew earlier

22 March 2021 (updated 01 June 2024)When it comes to saving and investing for later in life, the earlier the better. Here are some things I wish I knew when I first started earning a salary.

Disclaimer: I am not a financial advisor. I cannot provide financial advice to you, this is purely for educational purposes. When you invest, your capital is at risk.

Be more aggressive with your pension

The first thing I wish I did as soon as I got auto-enroled in a workplace pension is to move to a higher risk fund.

For most workplace pensions, the default fund is very moderate, but in your 20s you can handle the volatility of the stock market, so move to the most aggressive fund. This usually means more equities, fewer bonds.

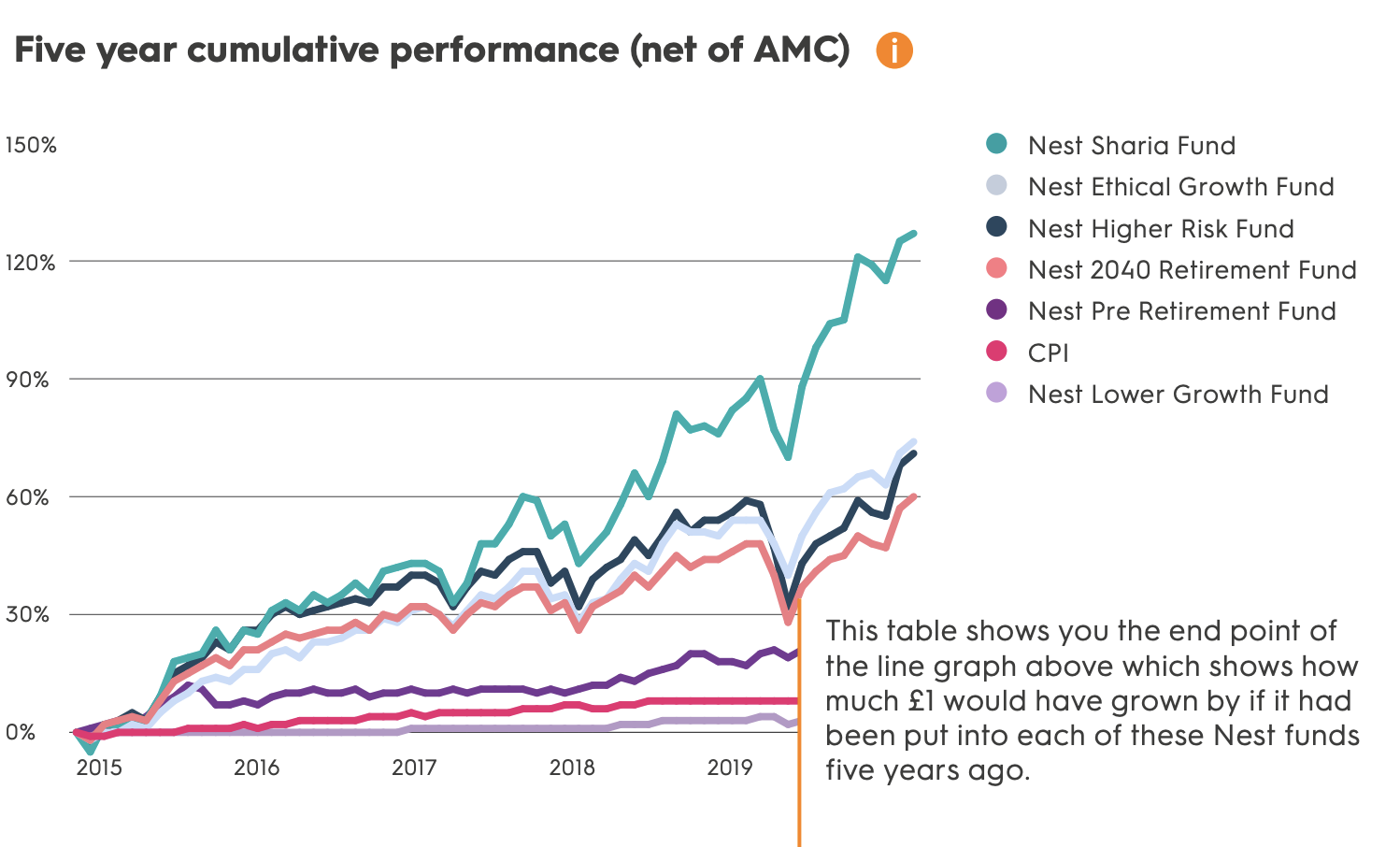

If you’re auto-enrolled with NEST as most people are, their most aggressive option is the Sharia Fund, which is 100% equities. Have a look at its recent performance compared to all other NEST funds 1:

(past performance is not a reliable indicator of future results)

Investing is not scary

One of the reasons I put off investing in stocks and shares for a while was because I was scared to put money somewhere I didn’t fully understand. With a little bit of reading, and after realising your pension is actually invested, you’ll soon realise investing in the markets isn’t a scary thing. You already do it.

Luckily, you don’t have to be a hands-on investor to do well. You can start by investing in index funds, which track a wide variety of companies across the world. That way your risk is minimised because if a few companies in the fund out of hundreds goes bust, you won’t take a big hit.

To put this more eloquently, in the words of John C. Bogle, American investor and creator of the first index fund:

Don’t look for the needle in the haystack. Just buy the haystack!

Optimise your emergency fund

Cash loses buying power (hello inflation) over time, so if you keep all your money in your current account, you will lose money every year. But keep no cash at all, and you risk relying on borrowing and getting into debt in case of an unexpected expense.

So it’s a good idea to keep an emergency fund i.e. money you can use immediately without selling investments in case you have a financial emergency.

But how much cash should you keep? That’s a very personal question which will depend on your own appetite for risk and other life circumstances.

Some people recommend keeping 6 month’s plus worth of living expenses as cash in case of an emergency. Others recommend as little as one month. Experiment with different amounts and find what feels right for you.

Always ask yourself if you’re holding too much money in cash, and give your emergency fund a trim if needed.

Don’t save then invest, save AND invest

As you build your emergency fund, you don’t have to defer investing. You can do a bit of both, moving towards more investing and less saving as you approach your desired emergency fund value.

No matter how little you can put aside, consider setting up a Vanguard Stocks and Shares ISA and contributing monthly to it. You only get a tax-free allowance of £20,000 every year, so it’s better to contribute now than when you’re able to contribute the maximum amount, as you would have missed previous year’s allowances.

Say you can save £100 per month. Instead of keeping all of it in your current or savings account, you can save, say, £75 and invest £25. The closer you get to your ideal balance in cash, the more you can shift this split towards investments, untill eventually 100% of extra money goes into the stock market.

Reconsider savings accounts

(This section has been updated to reflect current interest rates).

You really only need one high-interest savings account where you keep your emergency fund. Nowadays in the UK you can get 4-5% interest on easy access savings.

But make sure they’re easy access as you might need to rely on this money quickly in case of an unexpected large expense.

Besides a savings account for your emergency fund, and the money you keep in your current/checking account for daily expenses, the rest of your money should be invested to make the most out of it.